Fill out W-2 form online in 2025 - simplify your tax season

Get your Form W-2

![Fill out [form_name]](/_next/image?url=%2Fimages%2Ffill_1.webp&w=750&q=75)

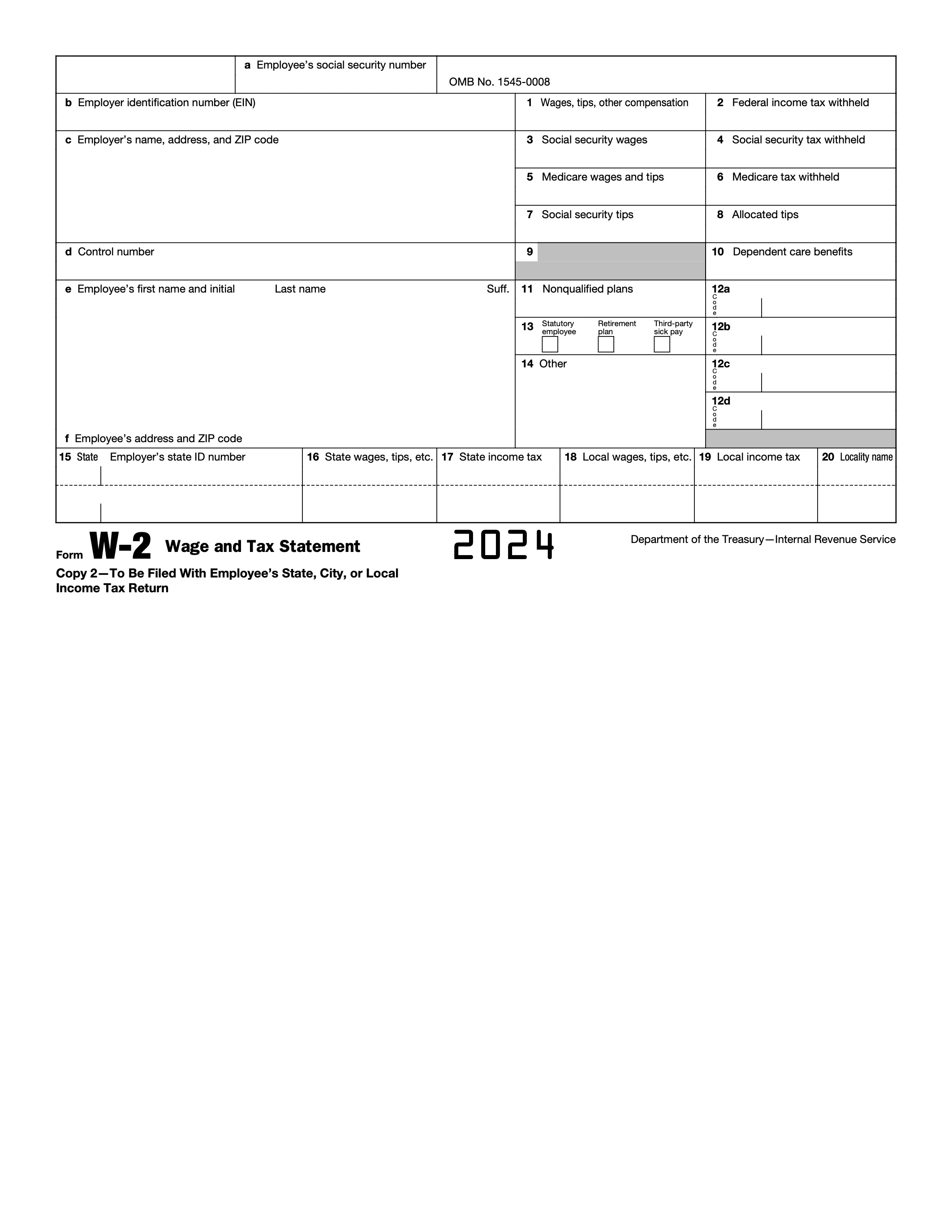

Fill out Form W-2

Enter your personal or business information directly into the form — fast, accurate, and easy.

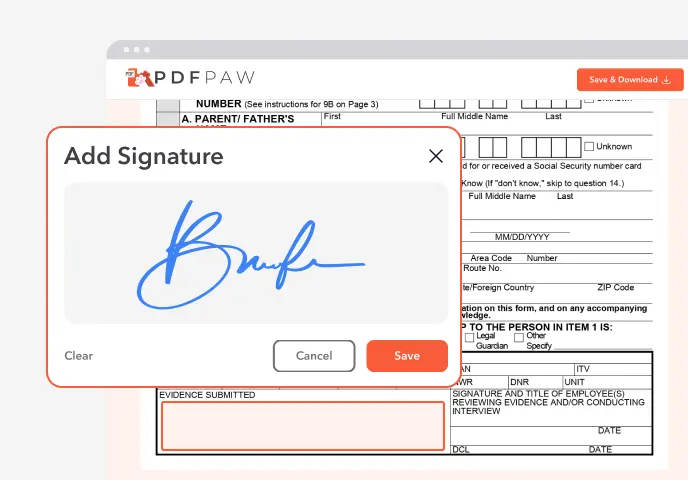

Sign the Form

Insert your legally-binding digital signature anywhere on the document.

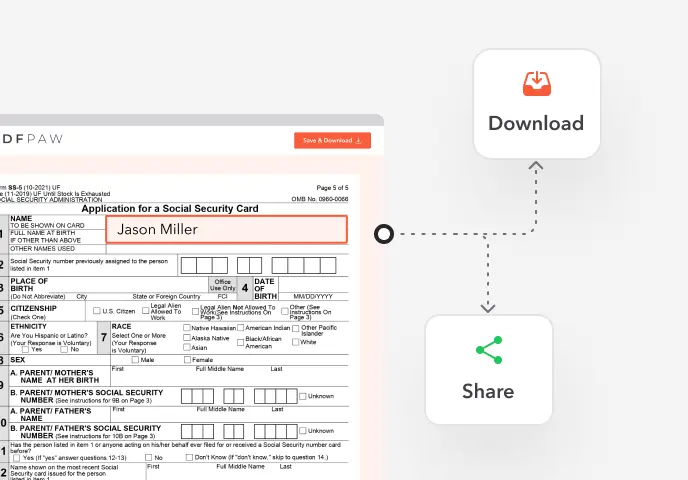

Download or Share

Download your completed Form W-2 instantly or share it with others.

How to get a blank W-2 form?

Visit our site for a blank Form W-2 ready for completion and download, ensuring ease in filling and storing.

When is a W-2 form not required?

Self-employed individuals and contractors often use Form 1099-NEC instead of W-2 for income reporting.

How to fill out a W-2 form?

Load the W-2 in the PDF editor, enter details like EIN, wages, and taxes, then review and download.

Complete your Form W-2 now!

Fill out W-2 form online in 2025 - simplify your tax season

Fill FormWhen is a W-2 form due?

Employers must send W-2 forms to employees and the IRS by January 31st after the tax year concludes.

Who is required to fill out Form W-2?

Employers complete Form W-2 for employees to report wages and taxes withheld for tax filings.

Where to file a W-2?

Submit the completed W-2 to the SSA online or by mail and provide a copy to employees.

What is a W-2 form?

The W-2 details earnings and tax information essential for employee tax filing accuracy.

What is a W-2 form used for?

It reports an employee's annual income and taxes withheld, mandatory for tax return preparations.

How to sign W-2 form online?

Sign online by uploading your form to PDF Maxi, adding details, then applying a digital signature.

Trusted and Secured by Industry Experts

What users are saying about our Online Tool

Frequently Asked Questions

Related Forms

A notice of intent to vacate is a letter that informs the landlord you plan on moving out of your rental property. This allows you to meet any requirements about advance notice in your lease agreement.

Form DS-11, Application for a U.S. Passport, is used by individuals applying for their first U.S. passport, those under 16, or those whose previous passport was lost, stolen, or expired more than 15 years ago. It collects essential personal information for identity verification and passport issuance.

Form W-9 is essential for freelancers, independent contractors, and vendors to provide their Taxpayer Identification Number (TIN) to entities that pay them, ensuring proper tax reporting to the IRS.